‘If you build it, they will come’: California Desert Cashes in on Early Cannabis Investment

DESERT HOT SPRINGS, Calif. — Along a hot, dusty stretch of freeway in California’s Coachella Valley, a green rush is booming that not even the coronavirus pandemic can slow.

Desert Hot Springs, once a sleepy retirement community overshadowed by its more glamorous neighbor, Palm Springs, to the south, is transforming into a cannabis-growing capital as businesses lured by tax incentives and a 420-friendly local government pour into the small city.

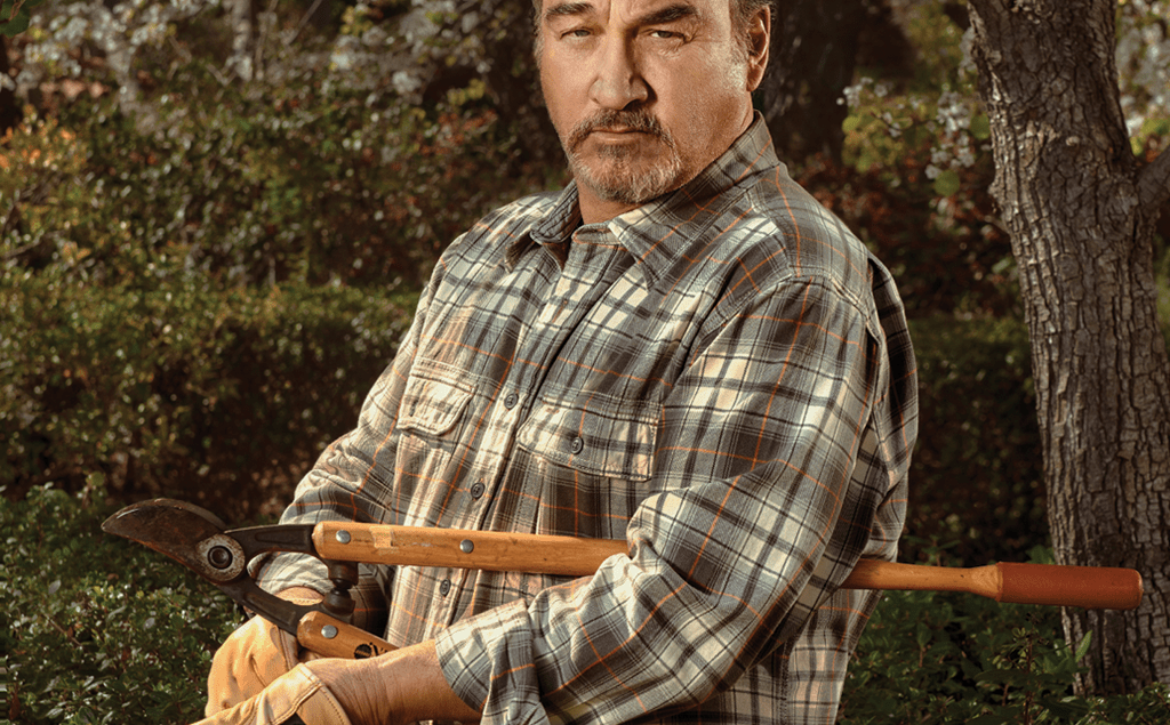

“It’s fun times right now to be the mayor,” said Mayor Scott Matas, who has been in city government since 2007 and once voted to implement a moratorium on cannabis businesses.

Last year the industry contributed more than $4 million to city revenue, overtaking real estate as the biggest generator of tax profit, Matas said. City officials anticipate an even higher revenue stream from cannabis businesses this year.

Deputy City Manager Doria Wilms said: “It’s been incredible to see the transformation. We don’t see it slowing down.”

A new industry blossoms

It took Gold Flora CEO Laurie Holcomb only 48 hours to decide to open a cultivation business in Desert Hot Springs after it began to allow large-scale operations. She already owned a real estate development company and saw an opportunity to expand into the growing industry.

In eight growing rooms inside Gold Flora’s cultivation facility, insulated metal panels similar to those in walk-in coolers shield more than 9,000 cannabis plants from the unrelenting sun. Even without air conditioning, the building will never heat up beyond 80 degrees inside despite triple-digit temperatures outside, facilities manager Adam Yudka said. Plants are stored atop rolling benches that use an internal irrigation system to water crops individually.

Gold Flora owns and operates five warehouse-size buildings, some of which are rented to other cannabis businesses. The sprawling campus, covering about 23 city blocks, was built from the ground up.

“Most people, when they think about the desert, they think they’re going out in the middle of nowhere,” Holcomb said. “It made sense that if you build it, they will come.”

A city brought back from the brink

Gold Flora and other companies like it represent a major shift for the desert economy. Matas, who was re-elected to a third term in November, remembers a time around 2011 when the city had just “$400 in the bank.” City officials froze salaries, cut programs and considered filing for bankruptcy protection, Reuters reported. The city had previously filed for bankruptcy in 2001.

The tax revenue has already helped to pay for a new City Hall, a library and roads, as well as more police officers. Housing developers eye the area as jobs attract more people to the desert. Residents also benefit from the boom — of about 29,000 residents, at least 2,300 work in the cannabis industry, Wilms said.

Desert Hot Springs, about two hours east of Los Angeles near Joshua Tree National Park, boasted more than 200 spas throughout the 1940s and the 1950s that were fed by a natural underground aquifer, which still provides water for much of the Coachella Valley. But the city had fallen on hard times financially in the last 20 years.

In 2013, the city declared a fiscal emergency to avoid filing for Chapter 9 for a second time, the Los Angeles Times reported. The city had emerged from its first bankruptcy filing in 2004, but less than 10 years later its reserves were dwindling again after an economic downturn and decreased development.

Continue Reading at nbcnews.com